When the UK left the EU VAT regime on 1 January, it added additional complexities for customs declarations, goods regulations, services and VAT rules relating to imports and exports from the EU. However, the VAT rules relating to domestic transactions continues to operate largely unchanged.

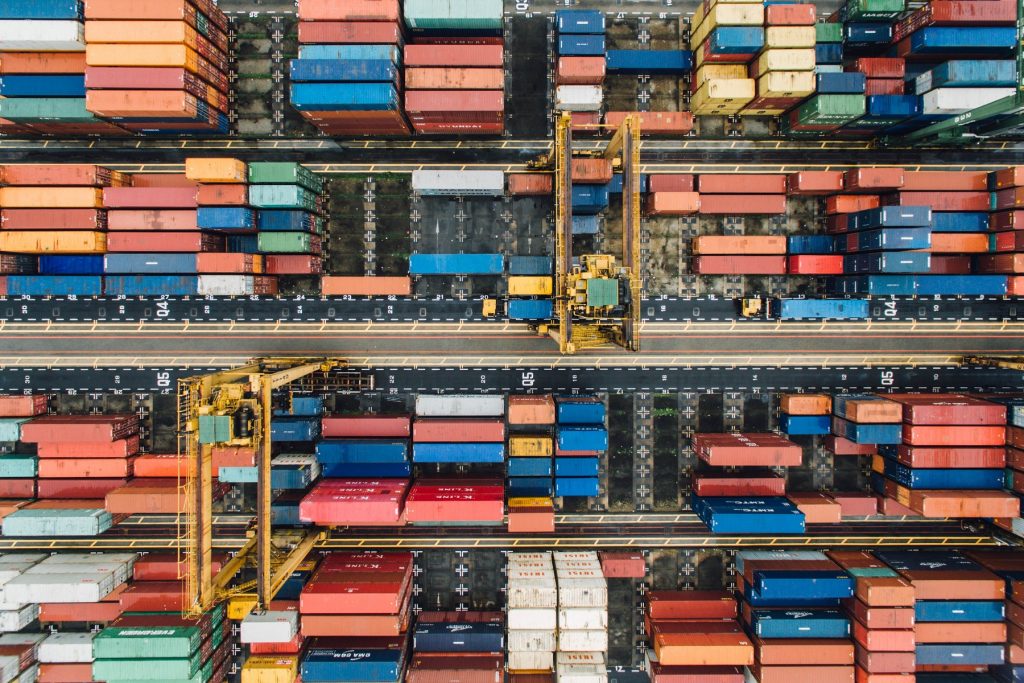

So, what are the main changes to VAT for transactions between the UK and EU member states? All movements of goods are now classed as imports or exports, and therefore subject to UK or EU import VAT. Now we are outside of the EU customs and VAT systems, it means businesses have trade borders and customs formalities to manage when importing or exporting.

Customs brokers or freight forwarders can assist with most of the additional customs procedures required, but when it comes to VAT, it is helpful to have your own knowledge of how payments should be handled.

Importing goods from the EU

The rules that previously applied to VAT on imports from non-EU countries now applies to imports from the EU, with some adjustments.

We have introduced ‘postponed accounting’ for import VAT on goods brought into the UK from the EU or non-EU countries. This enables businesses to account for the VAT on their next VAT return, rather than paying it when, or soon after, the goods arrive at the UK border. It also means the process of releasing the goods from customs can be expediated, without the requirement for VAT payment.

Customs declarations and the payment of other duties still apply, although these can be postponed and settled monthly with a duty deferment account – this can be arranged through HMRC.

VAT on imports of £135 and under

There are different VAT rules for imported goods either side of the £135 threshold. UK supply VAT, as opposed to import VAT, is now due on imports with a value of up to £135. This is because the VAT is being collected at the point of sale, rather than the point of importation. It is the responsibility of the Online Marketplace (OMP) that sells the imported goods to collect and account for the VAT, even when the goods are in the UK at the point of sale.

For business-to-business transactions, the VAT is reversed charged to the customer. Businesses receiving goods of £135 or less should account for the VAT as part of the reverse charge procedure, declaring it on their next return.

VAT on imports exceeding £135

On these imports, businesses will have to account for import VAT. The VAT is applied at the point the goods enter circulation (the tax point). Documentation will be required for your VAT records to show the point the goods entered free circulation.

VAT can be paid at the tax point, this requires you to obtain monthly C79 reports from HMRC, as would be done if importing from outside the EU. The postponed accounting system can be used, with VAT accounted for as input and output on the same return.

Exporting goods to the EU

Exports to the EU are now treated as they would be to non-EU countries. This means that exports should be zero-rated for VAT, this applies to both B2C (business to consumer) and B2B (business to business) transactions.

With zero-rated VAT, it is important to note that no VAT is payable, yet the exports must still be included as part of your VAT accounting. Evidence should be retained to show that the goods have left the UK, there is no longer a requirement to complete an EC Sales List.

Import tax

Additional complications arise when the exported goods reach their EU destination, Import VAT will be due and someone will have to account for it before the customer gets their goods.

The difficulty is, who pays this import tax and how? Here are some options to consider

- Arrange for the shipping agent to pay for the destination country’s Import VAT, they would then invoice you for the VAT, plus their admin fee.

- Inform the end customer that they are required to pay the Import VAT prior to receiving their goods. However, this may delay the arrival of the goods until the VAT is paid to their local post office or the courier firm delivering the parcel.

- Register for VAT in each EU country that your business supplies. So, for example, if your business exported to Spain, it is here that you would account for the Spanish Import VAT on the Spanish VAT return, which could then be reclaimed. The business registered in Spain would then supply the goods to the customer, charging and accounting for Spanish VAT as appropriate. This would ensure the same customer experience as pre-Brexit, with no uncertainty as to VAT or duties. If your business sells to several EU member states, the requirement to maintain multiple VAT registrations could be cost prohibitive.

- Register for VAT in one EU country (for example Ireland) and make all your supplies to customers in other EU countries from stocks held there. However, as then being a business registered for VAT in the EU, distance selling rules would apply, so once sales from Ireland to another EU member state exceeded their distance selling limit you would have to register for VAT in that country as well.

The supply of services

For B2B sales of services, things will normally be subject to tax in the country of the consumer and administered through reverse charge.

For the sale of B2C services, VAT is generally due where the supplier is based. However, there are exceptions to this that include where the service is used and enjoyed, services relating to land, and services of a professional, technical, financial, intellectual or other intangible nature.

MOSS

Businesses can no longer use VAT MOSS (Mini One-Stop Shop) in the UK and returns for Q4/2020 should be submitted by 20 January 2021.

If you currently use MOSS to account for supplies of digital services to customers in the EU, you will need to register for VAT in an EU state and then register for the non-union MOSS system there. Ireland is a country being considered by many businesses registering for the MOSS non-union scheme, as the rules are similar to here and there is no language barrier.

For any enquiries relating to the new VAT rules for importing or exporting please do get in touch with us and we will be happy to help.