The Government has announced plans to introduce a new UK-wide 1.25% Health and Social Care Levy (the Levy) based on National Insurance Contributions (NICs) for both employees and employers. There will also be an equivalent 1.25% increase on the tax rate applied to dividends.

The Levy will be introduced from April 2022, when NICs for working age employees, employers and the self-employed will increase by 1.25%. The Levy will be administered by HMRC and collected in the same way as NICs – Pay As You Earn and Income Tax Self-Assessment. It will be included on payslips and a generic message could appear on payslips in the next tax year.

From April 2023, once HMRC’s systems are updated, a formal legal surcharge of 1.25% will replace the increase in NICs rates.

Why introduce the Levy?

The Levy is being introduced to address the funding required for health care and long-term reforms to the social care system. The increased taxes will raise almost £36 billion for health and social care over the next three years.

The Levy shares the cost of improving the health and social care systems between individuals and businesses across the UK. Basing the Levy on NICs means that employers will be asked to pay more alongside most employees and the self-employed.

Who does it apply to?

The Levy will apply to the same individuals and income as Class 1 (Employee, Employer) and Class 4 (Self-Employed, including partners) National Insurance, and to the main and higher rates.

From April 2023 onwards, the Levy will also apply to those above State Pension age who are still in employment.

The increase will not apply to Class 2 NICs (the flat rate paid by the Self-Employed with profits above the Small Profits Threshold, which is currently £6,515 per year) or Class 3 NICs.

Impacts of the Levy

According to the Government’s briefing document:

- A typical basic rate taxpayer earning £24,100 will contribute an extra £180 in 2022-23;

- A typical higher rate taxpayer earning £67,100 will contribute an extra £715 in 2022-23;

- Additional rate taxpayers make up just two per cent of individuals affected but will contribute nearly 20 per cent of the revenue raised from individuals; and

- The highest earning 14 per cent will pay around half the revenue.

The Employment Allowance, which discounts the smallest businesses’ employer NICs bills by up to £4,000, will also apply to the Levy. As detailed in the Government’s briefing document, this means that around 40% of businesses will not be affected at all by the Levy.

Shares held in ISAs are not subject to dividend tax and, due to the £2,000 tax-free dividend allowance and the personal allowance, around 60 per cent of individuals with dividend income outside of ISAs are not expected to pay any dividend tax or be affected by this change in 2022-23.

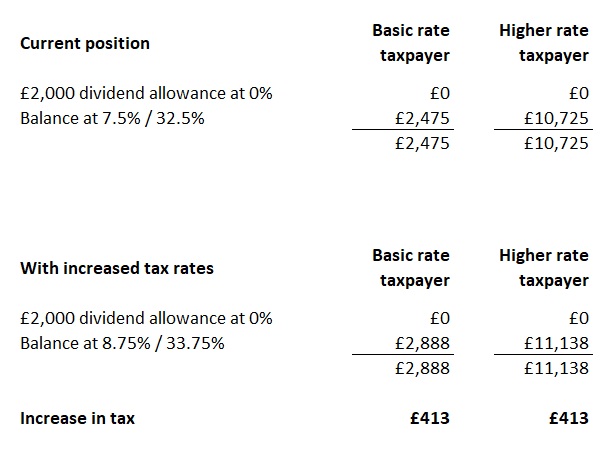

Example of the impact of an increase in taxation of dividends

The example below is based on a £35,000 dividend, and assumes that the personal allowance is already utilised elsewhere.

This is the information that is currently available on the new Levy. We will be in touch with further details as soon as they are published. Should you have any queries then please either get in touch with your usual M+A Partners contact or email enquiries@mapartners.co.uk and we will be happy to help.