The government have updated some of the guidance and rules for the Coronavirus Job Retention Scheme (CJRS), below is an overview of some of the additional information not already covered in our CJRS Factsheets.

Employers should be reminded that, unless you are making a new claim for an employee who is a military reservist or is returning from statutory parental leave, you can only continue to claim through the scheme if:

- The employee was previously furloughed for 3 consecutive weeks between March 1 and 30 June; and

- The claim was submitted before 31 July.

Deciding the length of your claim period

Further guidance has been released on deciding the length of your claim period, this information is required when calculating how much you can claim from the Coronavirus Job Retention Scheme.

- The claim period should be matched to the dates your payroll is processed;

- Only one claim can be made for any period, so all furloughed or flexibly furloughed employees should be included in one claim even if they are paid at different times;

- When making more than one claim, subsequent claims cannot overlap with any other claim;

- Where employees have been furloughed or flexibly furloughed continuously (or both), the claim periods must follow on from each other with no gaps in between the dates;

- Claims can be made before, during or after you process your payroll;

- Claims can be made up to 14 days before your claim period end date and you do not have to wait until the end of a claim period to make your next claim;

- When claiming for employees who are flexibly furloughed, you should not claim until you are sure of the exact number of hours they will have worked during the claim period; and

- If you claim in advance and your employee works for more hours than you have advised, you will be required to pay some of the grant back to HMRC.

Examples of an employer calculating a claim

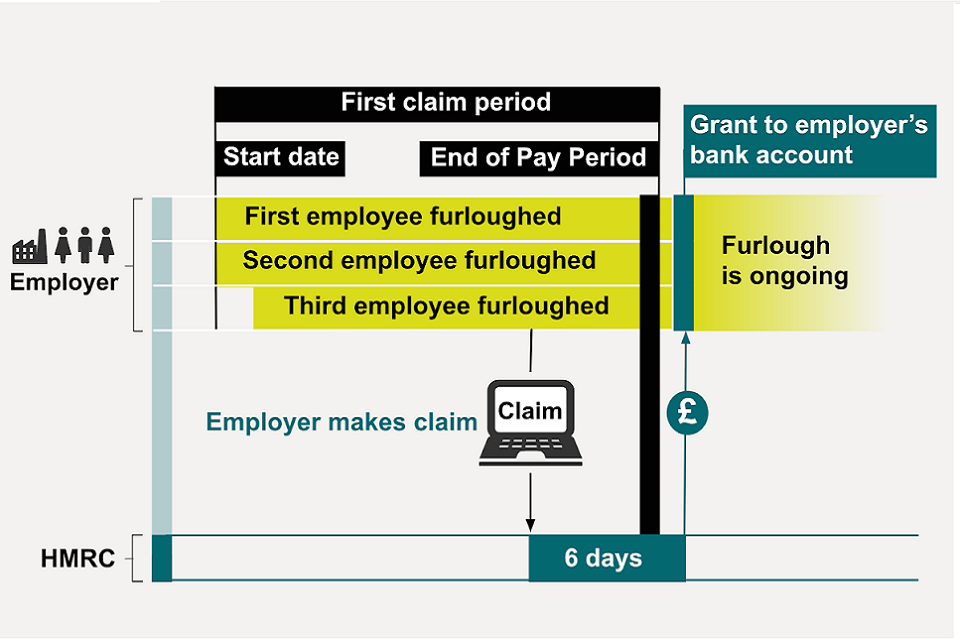

Scenario: Two employees are furloughed at the start of the pay period and a third is added a short time later

(image taken from gov.uk)

(image taken from gov.uk)

- The start date of the claim period is when the first employee was put on furlough;

- The employer should include all employees who were furloughed during this claim period, even if they were put on furlough at different times within the period or are paid at different times in the pay period; and

- The claim is then made 6 days before the end of the pay period, ensuring that the grant is available to be paid out then.

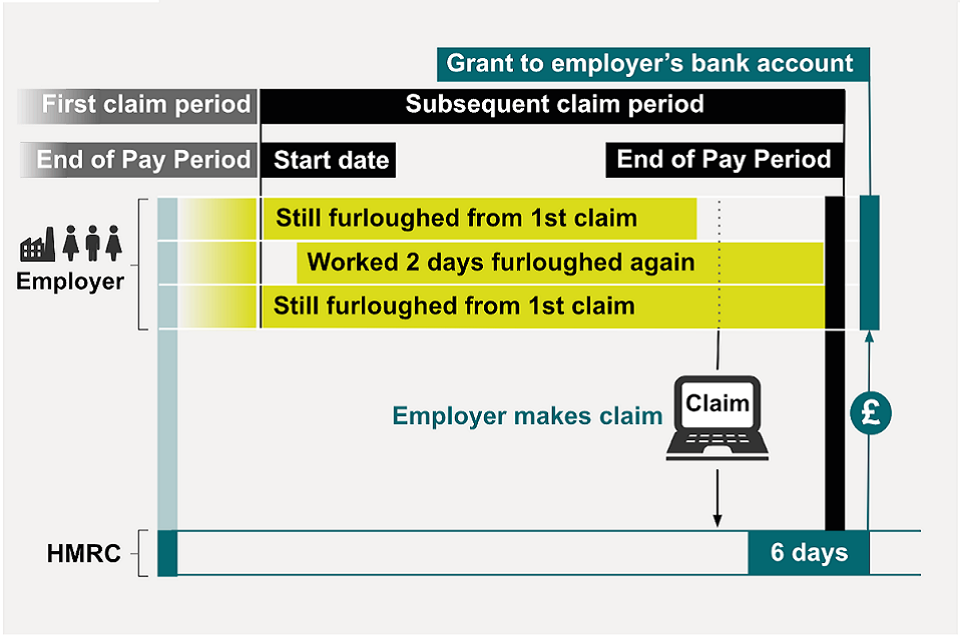

Scenario: Making another claim after the first one has ended

(image taken from gov.uk)

(image taken from gov.uk)

- Two employees have been furloughed continuously since the first claim, and the claim periods follow on with no gaps in between the dates – though one returns to work before the end of the pay period;

- One employee worked for two days at the start of the second period but is then furloughed again; and

- The employer should include all employees who were furloughed during this claim period, even if they were put on furlough at different times or are paid at different times in the pay period.

What to include when calculating wages

When calculating 80% of employees’ wages for hours not worked, the amount should be made up of the regular payments you are obliged to make, including:

- Regular wages you paid to employees;

- Non-discretionary payments for hours worked, including overtime click here for more details on working out if a payment is non-discretionary and non-discretionary overtime payments;

- Non-discretionary fees;

- Non-discretionary commission payments; and

- Piece rate payments.

Employers cannot include payments made at the discretion of the employer or client (where the employer or client was under no contractual obligation to pay), including:

- Any tips, including those distributed through troncs;

- Discretionary bonuses;

- Discretionary commission payments;

- Non-cash payments; and

- Non-monetary benefits like benefits in kind (such as a company car) and benefits received under salary sacrifice schemes (including pension contributions) that reduce an employee’s taxable pay.

Additional points to note on employees’ wages

- The entirety of the grant received to cover an employee’s subsidised furlough pay must be paid to them in the form of money. No part of the grant should be netted off to pay for the provision of benefits or a salary sacrifice scheme;

- Where the employer provides benefits to furloughed employees, including through a salary sacrifice scheme, these benefits should be in addition to the wages that must be paid under the terms of the Job Retention Scheme; and

- Normally, an employee cannot switch freely out of most salary sacrifice schemes unless there is a life event. HMRC agrees that COVID-19 counts as a life event that could warrant changes to salary sacrifice arrangements, if the relevant employment contract is updated accordingly.

Apprenticeship Levy & Student Loans

- You should continue to pay the Apprenticeship Levy as usual. Grants from the Job Retention Scheme do not cover the Apprenticeship Levy; and

- You should also continue to make Student Loan deductions from the wages you pay to employees.

National Minimum Wage

- At least minimum wage rates must be paid for all hours worked;

- Furloughed workers who are not working can be paid the lower of 80% of their wages or £2,500 even if, based on their usual working hours, this would be below their appropriate minimum wage; and

- Time spent training whilst furloughed is treated as working time for the purposes of the minimum wage calculations and must be paid at the appropriate minimum wage rate.

Limited Liability Partnerships (LLP)

If a member of an LLP is treated as an employee (because of salaried members rules), you must only include payments that are either:

- Fixed;

- Variable, but are varied without reference to the overall amount of the profits or losses of the LLP; or

- Not affected by the overall amount of the LLP’s profits or losses.

Holiday pay

- Furloughed employees continue to accrue leave as per their employment contract;

- The employer and employee can agree to vary holiday entitlement as part of the furlough agreement, however almost all workers are entitled to 5.6 weeks of statutory paid annual leave each year which they cannot go below;

- Employees can take holiday while on furlough;

- If an employee is flexibly furloughed then any hours taken as holiday during the claim period should be counted as furloughed hours rather than working hours; and

- Employees should not be placed on furlough for a period simply because they are on holiday for that period.

Employees returning from family-related statutory leave or after being on sick pay

- For employees on fixed pay, claims for full or part time employees furloughed on their return to work should be calculated against their salary, before tax, not the pay they received whilst on family-related statutory leave or sick pay.

Working out employee’s usual and furloughed hours

To take advantage of the flexible furlough scheme, employers are required to calculate ‘usual hours’ and ‘furloughed hours’. Additional details have been published on this, including:

- Usual hours can be calculated for the entire claim period or for each pay period, or part of a pay period, that falls within that claim period;

- If you calculate the usual hours for the entire claim period and the result is not a whole number, you should round it up to the next whole number; and

- If you calculate the usual hours on a pay period basis you should round the result up or down to the nearest whole number.

Click here for additional guidance on calculating ‘usual hours’ for employees working fixed hours.

HMRC will not decline or seek repayment of any grant based solely on the particular choice between fixed or variable approach to calculating usual hours, as long as a reasonable choice is made.

Calculating 80% of an employee’s usual wage – if your fixed pay employee has worked overtime

New guidance has been released on how to calculate your claim for fixed pay employees who have worked enough overtime (in the tax year 2019 to 2020) to have a significant impact on the amount you need to claim.

- You should calculate 80% of their usual wages using the method for employees whose pay varies.

Examples of situations where overtime could have a significant effect on the claim amount include where the employee worked overtime:

- In the last pay period ending on or before 19 March 2020

- In the corresponding calendar period to the period you are claiming for; or

- A lot, or often, in the tax year 2019 to 2020.

You do not need to amend any previous claims, however if these circumstances apply you should use the calculation for employees whose pay varies for any future claims.

Clarification of employees that can be furloughed

Click here for detailed guidance on which employees can be furloughed

Additional details on CJRS, including working out the maximum wage amount and calculating 80% of an employee’s usual wage can be found in our factsheets below.

Coronavirus Job Retention Factsheet: from 1 July 2020

Coronavirus Job Retention Factsheet: from 1 July 2020