The online service to make a claim through the fourth Self-Employment Income Support Scheme (SEISS) grant is now open.

The eligibility criteria for the fourth grant are notably different from the SEISS grants that preceded it, specifically the requirement to have a ‘reasonable belief’ that there will be a ‘significant reduction’ in trading profits.

Without proper assessment of these requirements, claimants risk exposing themselves to HMRC penalties if it is later determined that the criteria have not been met.

With the very specific eligibility conditions required by the fourth SEISS grant, it is important to be aware of the procedure for reporting overpaid grant amounts and the process HMRC will action in recovering these amounts.

Informing HMRC about overpayments

If a SEISS grant has been overclaimed and not repaid to HMRC, they must be informed within their notification period – this is 90 days after the overpaid SEISS grant is received.

To recover the full amount of an overpaid grant, HMRC will make a tax assessment. If an assessment is made, the claimant will be notified by HMRC and payment must be made within 30 days of the assessment.

Interest will be charged on any late payments and HMRC may also charge late payment penalties if the amount remains unpaid 31 days after the due date.

Overpayments and Self Assessment

If the overpaid grant is repaid, or HMRC have made an assessment by the date the tax return is submitted, it does not need to be included in the Self Assessment tax return for 2020 to 2021.

If the overpaid grant is not repaid and HMRC have not made an assessment by the date the tax return for 2020 to 2021 is submitted, details of the overpaid SEISS grant must be included in the return.

Penalties

A penalty may be charged if HMRC are not informed, within the notification period, about an overpaid grant that the taxpayer was aware they were not entitled to.

The penalty could be up to 100% on the amount of the SEISS grant that the claimant was not entitled to receive or keep.

If the taxpayer was not aware they were not entitled to the grant, a penalty will only be charged if the grant has not been repaid by 31 January 2022.

The HMRC Payment Support Service can be contacted on 0300 200 3835.

Email scams

It is vitally important to stay vigilant and mindful of all requests that you receive asking for personal information or any contact from someone purporting to be from HMRC.

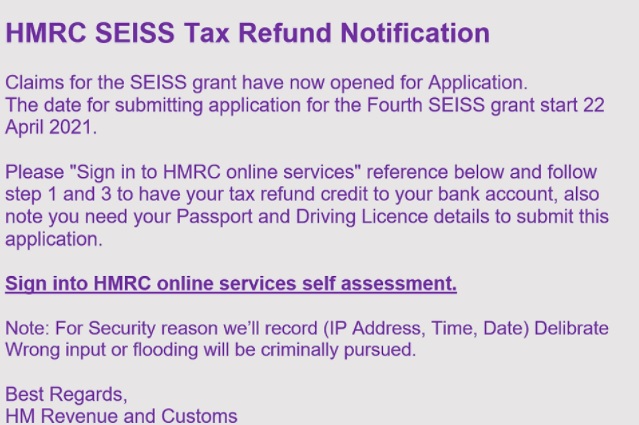

Increasingly, some of the fraudulent campaigns in circulation are extremely convincing and persuasive. There is a current email scam targeting claimants of the fourth SEISS grant, the email has the subject line “HMRC SEISS Tax Refund Notification” and uses an official GOV.UK logo.

Below is an example of the scam

There are grammatical errors within the email, highlighting it as a phishing scam, in addition to the fact it refers to the grant as a ‘tax refund’ rather than a grant.

The email asks the recipient to click on a hyperlink to make their claim and then advises them that their passport and driving licence details are required in order to complete the claim.

Recipients of the phishing scam have advised to be heedful of any emails from support@access.service.gov.uk (mailto:support@access.service.gov.uk)