Now that the UK has left the EU, there is a transition period until the end of 2020. This means the current rules on trade, travel and business for the UK and EU will continue to apply, with new rules coming into effect on 1 January 2021.

Start preparing now for the changes.

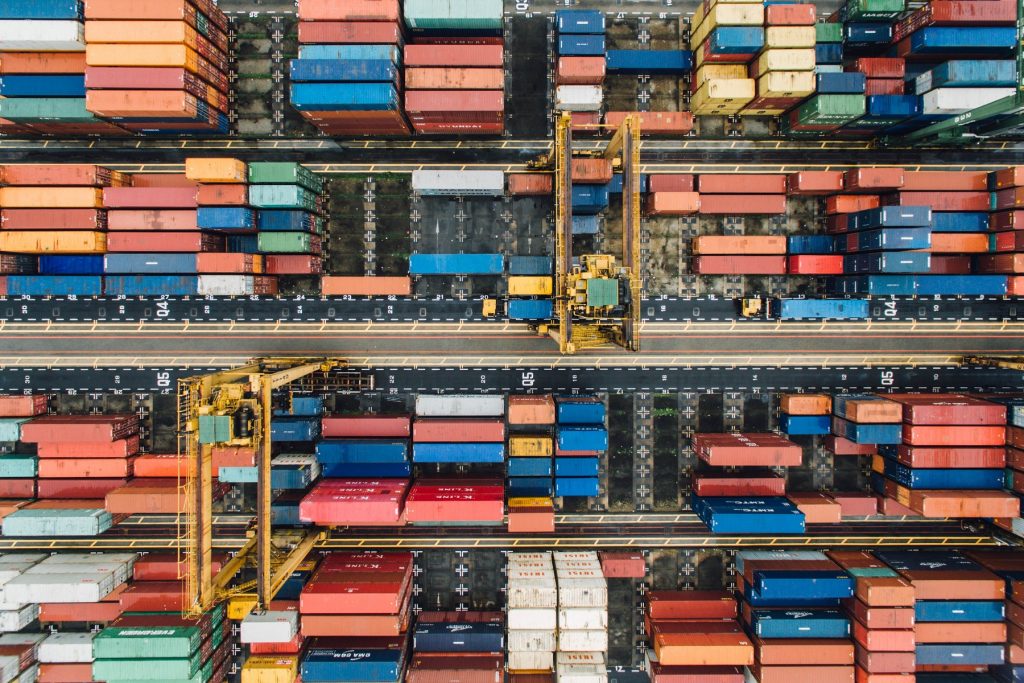

Importing and exporting

If you import or export goods to the EU, you should familiarise yourself with the procedures you will need to adhere to. Failure to do so may negatively impact your supply chain if goods are held up, resulting in potential fines and storage expenses.

From 1 January 2021, customs declarations will be required to move goods into and out of the EU.

To prepare you should ensure you have an EORI number. An EORI number, Economic Operator Registration and Identification number, is required by businesses which import and/or export goods to countries outside the EU, and is used by Customs to control and identify movements of goods.

Application is a reasonably easy process, and links to the forms and HMRC guidance may be found here. There are different application forms depending on whether you are VAT registered or not.

It may be necessary to engage Freight Forwarders, Customs Agents or Brokers, or Express Couriers to handle the customs processes on behalf of your company whilst you get things up to speed. Alternatively, you may apply for government grants to fund training for employees and the requisite IT software to make Customs Declarations.

Here are a few changes specifically related to VAT:

Subject to the terms of a trade agreement that may be reached, it may not be possible to use HMRC’s VAT online services to claim a VAT refund from an EU member state after 5pm on 31 January 2020.

Refund claims will need to be made using the existing processes used by businesses based outside the EU, even where the claim is for expenses incurred before Brexit.

Find out what the process is for each country here.

The deadline is therefore not the deadline by which a claim for EU VAT incurred in 2019 must be made, but it is the deadline for such a claim to be made via the HMRC Online Portal. The deadline is tight, but if it is possible to do so, the process for claiming VAT via the HMRC Portal is likely to be simpler.

Pay VAT when you sell digital services to EU customers from 1 January 2021

From 1 January 2021, you will no longer be able to use the UK VAT MOSS system (Mini One Stop Shop) to declare sales and pay VAT if you sell digital services to EU customers.

The final return period for the UK’s VAT MOSS system will be the period ending 31 December 2020, your return should be submitted by 20 January 2021 and amended by 20 February 2021. You should only include sales made before 1 January 2021 in your final return.

For sales made from 1 January 2021, you should register for either VAT MOSS in any EU member state or VAT in each EU member state where you sell digital services.

What can you do today?

Get in touch with M+A Partners to discuss your supply chain, any vulnerabilities and the impact Brexit could have on your business.

If you need assistance with customs procedures, take a look at this guidance:

Appoint someone to deal with customs on your behalf

Apply for a Customs Training Grant